1099 hourly rate to salary calculator

Starting salary for a GS-12 employee is 6829900 per year at Step 1. Federal income tax rates range from 10 up to a top marginal rate of 37.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Use this calculator to view the numbers side by side and compare your take home income.

. Use this easy calculator to convert an hourly wage to its equivalent as an annual salary. 30 is the standard but use your actual if you know it 10 X. States dont impose their own income tax for.

If I recall dividends are taxed at 15. The Wage and Salary Conversion Calculator is used to convert a wage stated in one periodic term hourly weekly monthly etc into its equivalent stated in all other common. Hourly to Salary calculation.

Then a 1099 hourly. Use the IRSs Form 1040-ES as a worksheet to determine your. 2017-2020 Lifetime Technology Inc.

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. Online calculator should tell you taxes are 9134. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Create Edit and Export Your 1099 Misc. We have put together a calculator you can use here to calculate your personal hourly rate. To convert your hourly wage to its equivalent salary use our calculator below.

Adjusting- 91hr08 114hr on 1099. Median household income in 2020 was 67340. Next subtract your payroll and income taxes.

You could also incorporate same B2B model as above. Find out the benefit of that overtime. About Salary to Hourly Calculator.

Base Salary year. To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12. Here is how to calculate your quarterly taxes.

Divide the rate by the hours 100 10 hours 10hour GROSS. To decide your hourly salary divide your annual income with 2080. This is a great exercise to come up with a.

Ad 1 Create Your 1099 Form For Free In Minutes. For example how does an annual salary as an employee translate to an hourly rate as a contractor. So good - you net the same per year with 68500.

Just enter in a few details below to find out what. See where that hard-earned money goes - Federal Income Tax Social Security and. Divide this resulting figure by the number of paid weeks you work each year to get your hourly rate.

Let us help you figure that out. Then you need to enter. Except in addition you pay yourself a reasonable salary and the balance is paid in dividends.

Form Quickly and Easily. Convert 1099 dollars an hour to yearly salary. 2 File Online Print Instantly.

In the United States the rule of thumb is that salary pay rate that the employee sees only represents about half of the rate the employer has to charge a customer for their. Generate your paystubs online in a few steps and have them emailed to you right away. Hourly Monthly salary 12 Hours per week Weeks per year.

3000 dollars hourly including un-paid time is 6240000 dollars yearly including un-paid time. With W-2 designated employees businesses are required by law to cover employer taxes roughly a 15 markup on salary depending on where the employee lives and. Compare your income and tax situation when you work.

Ad Create professional looking paystubs. Calculate your adjusted gross income from self-employment for the year. We use the most recent and accurate information.

In order to convert an hourly rate to salary you need to first enter your hourly pay and an average number of hours per week that you bill. 1099 vs W2 Income Breakeven Calculator. Add that to SE taxes and youre at 18813 total taxes or a take-home of 49687.

How do I calculate hourly rate.

Solved W2 Box 1 Not Calculating Correctly

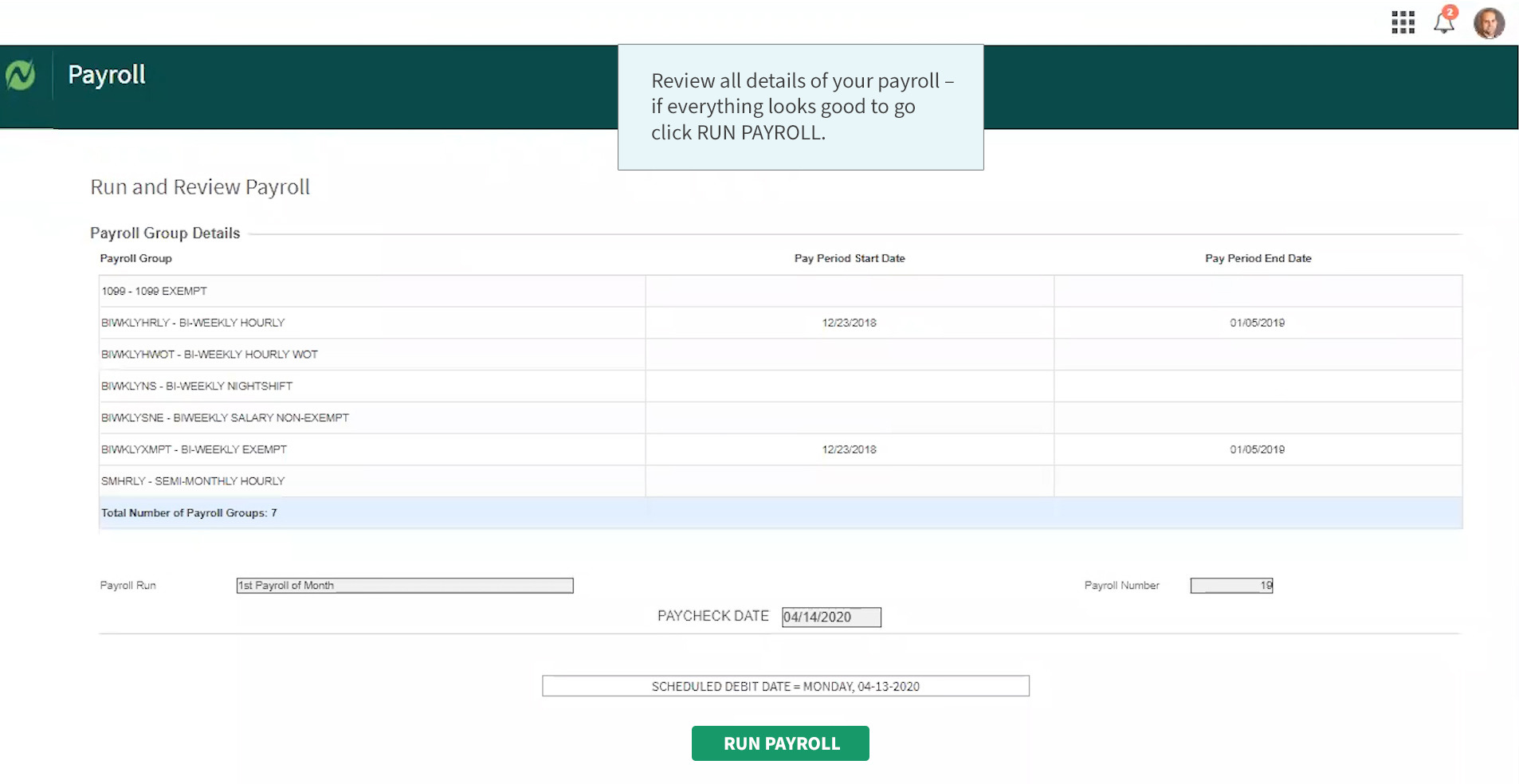

The Hourly Paycheck Calculator Netchex

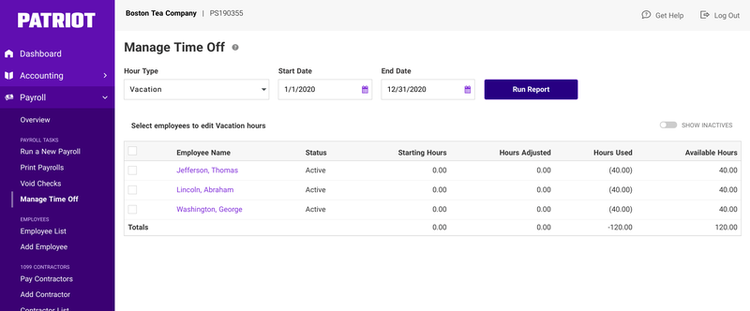

Toast Payroll How To Change An Employee From Salary To Hourly

Toast Payroll How To Change An Employee From Salary To Hourly

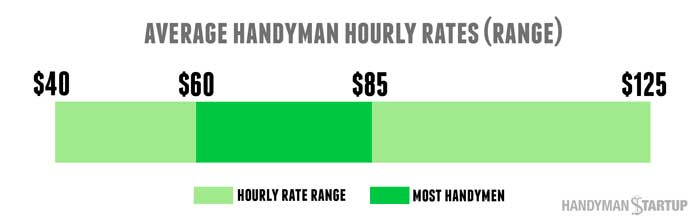

How To Calculate Your 1099 Hourly Rate No Matter What You Do

Salary To Hourly Salary Converter Salary Hour Calculators

What S Your Time Worth How To Determine Your Hourly Rate

Toast Payroll How To Change An Employee From Salary To Hourly

New York Hourly Paycheck Calculator Gusto

Toast Payroll How To Change An Employee From Salary To Hourly

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

2019 Salary Budgets Inch Upward Ever So Slightly Budget Forecasting Budgeting Salary

Salary Vs Hourly Pay Which Should Your Business Be Using

Should I Agree To Be Paid As An Independent Contractor

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Toast Payroll How To Change An Employee From Salary To Hourly